Financial Market Conditions April 2020

Global financial markets have continued to experience high levels of volatility over the past month as the nation grappled with the public health crisis and the economic downturn caused by the COVID-19 pandemic.

The coronavirus (COVID-19) continued to spread around the world over the past month with just over 3.4 million confirmed cases, just under 240,000 confirmed deaths and the virus now active in over 215 countries. The United States (US) is now the new epicentre of the virus with over 1.1 million confirmed cases and just over 60,000 confirmed deaths.

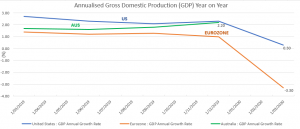

US jobless claims have spiked over the last month as working restrictions and social distancing meant that many businesses had to lay off workers. The US unemployment rate rose from 3.5% to 4.4% in March but many economists are concerned that the April unemployment rate could rise as high as 15%, driven by high jobless claims. Late in the month the US first quarter gross domestic product (GDP) printed at -4.8%, its first negative reading since 2014 with many economists predicting that the second quarter number is likely to print even lower.

Economic data out of the Eurozone revealed that the overall GDP of the zone shrunk by -3.3% last quarter with Italy and France experiencing even larger falls of -4.7% and -5.8% respectively.

The coordinated action of governments and central banks across the globe has meant that while some markets have continued to experience volatility, banks and other financial institutions have still been able to provide credit to individuals, businesses and corporations alike due to the large amount of liquidity being injected into money markets.

Australian financial markets have been volatile over the past month but over recent weeks markets have been buoyed by the low number of COVID-19 cases, high recovery rates and the low number of community transmissions. Like many parts of the world, the true economic impact of the pandemic has been hard to ascertain. The large stimulatory package released in the March quarter by the Australian federal government meant that people who are hopefully only temporarily unemployed due to the pandemic, stay connected to their place of work. In mid-April the Australian unemployment rate rose from 5.1% to 5.2% but as is predicted to occur around the world, the April data (scheduled to be released in May) is likely to print much higher. The Australian ASX-200 share equity index rose by approximately 9% over the course of the month recuperating some of the losses experienced in March. The Australian dollar appreciated by over $0.04USD over the course of the month and is now trading at just over $0.64 USD.

Since our last update, the RBA met twice (7 April and 5 May 2020) and at both meetings left the official cash rate at an all-time low of 0.25% and also committed to keep targeting a 3-year Australian Government bond yield of 0.25%. In the statement accompanying the May meeting, RBA Governor Lowe spoke about the effectiveness of the RBA’s bond buying program which they have committed to until progress is being made towards the goals of full employment and inflation, which they expect both will be compromised for some time. They also stated that the board will not increase the cash rate target until progress is being made towards full employment and inflation is sustained within the 2–3 per cent target band. Interest rate futures market pricing reflects this view.

Implied RBA Cash rate as at 30/04/2020: